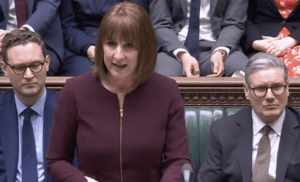

Chancellor Rachel Reeves has signalled that further tax rises may be on the way as economists warn she could be forced to fill a gaping £40 billion hole in the public finances at this autumn’s Budget.

The warning came after the Chancellor admitted there would be a “cost” to recent government U-turns on welfare reform — adding that the impact would be “reflected in the Budget”. Reeves, however, insisted she would not breach her fiscal rules, which limit borrowing — pointing instead to tax as the most likely lever left to pull.

It marks a potential reversal from her previous promise not to raise taxes again following last year’s record-breaking Budget, which imposed a £25bn National Insurance hike on employers and was blamed for stalling economic growth.

The Institute for Fiscal Studies (IFS) said Reeves may be forced to announce tax rises of up to £40bn to cover a combination of downgraded economic forecasts and spending commitments, warning that the government now faces a “perfect storm”.

“If growth forecasts are downgraded again and welfare spending continues to rise, you could comfortably be looking at a £20 to £40 billion Budget,” said Ben Zaranko, senior economist at the IFS. “That’s not what the government wants, but it’s certainly within the realm of possibility.”

The Office for Budget Responsibility (OBR) halved its growth forecast for this year back in March. A further downgrade of just 0.2 percentage points would alone open up an £18bn gap in the public finances.

The strain has been worsened by a series of U-turns on welfare. Last week’s decision to scrap cuts to Personal Independence Payments (PIP) could cost up to £6bn, while the climbdown on the winter fuel allowance is expected to add £1.5bn to the public bill. Labour backbenchers are also pressing for the abolition of the two-child benefit cap — a move that would add further pressure.

Reeves and Prime Minister Sir Keir Starmer have so far refused to detail how these commitments will be funded, but the Chancellor’s latest comments suggest higher taxes could be back on the table.

The Conservatives seized on the uncertainty, accusing Labour of economic mismanagement. Former Chancellor Sir Mel Stride said: “Labour’s welfare shambles has left the country facing a ticking tax timebomb. Businesses and hardworking families should brace themselves for further painful tax hikes.”

Paul Johnson, director of the IFS, said Reeves would face intense political pressure whichever path she chose. “She’s stuck between a rock and a hard place. Raise taxes and you upset markets or voters — or break your fiscal rules,” he said.

The backlash has already begun in Parliament, with several Labour MPs calling for wealth taxes or increased levies on high earners. But analysts warn this may undermine business confidence and growth just as the economy teeters on the edge.

Read more:

Rachel Reeves hints at fresh tax hikes amid fears of £40bn Budget black hole